nassau county tax rate per $100

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Property as established by the Nassau County Department of Assessment.

Nassau Ranks Fifth Among Highest Us Property Taxes Long Island Business News

An example of the way the new assessment works is that if your home was fully assessed at a worth of 300000 the total assessment.

. Your math would be simply. 54 rows Tax Rate. Residents of villages with their own forces paid 901 million toward the tax for 2012 according to the.

Nassau County collects on average 179 of a propertys assessed. Is there sales tax on clothes in Nassau County. Cost of the item x percentage as a decimal sales tax.

Nassau County Florida has a 6 sales tax and additional local option taxes which can raise the sales tax rate to up to 75. A rate per one hundred dollars of assessed value expressed in dollars and. In Nassau County the median property tax bill is 14872 according to state.

I cant figure this out. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your. The existing property tax rate was 074212 per 100 valuation which is what the rate has been for six.

Multiply retail price by tax rate Lets say youre buying a 100 item with a sales tax of 5. How is taxable value calculated in Nassau County. It is derived by multiplying your propertys FULL VALUE by the UNIFORM PCT OF VALUE.

The Nassau County tax impact letter including the newly assessed values. 072212 per 100 taxable value. If the check amount.

2022 Homeowner Tax Rebate Credit Amounts. 10 increase or 332 decrease every month. The Nassau Bay City Council approved the tax rate at 0648979 per 100 of valuation.

Nassau County property taxes. The median property tax in Nassau County is. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality.

BOARD OF ASSESSORS COUNTY OF NASSAU SCHOOL TAX RATES TOWN OF HEMPSTEAD 2003-2004 SCHOOL TAX LIBRARY TAX TOTAL SCHOOL DISTRICTS RATE RATE SCHOOL RATE. For 2012 the tax rate was 49347 per 100 of assessed valuation. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality.

The Fiscal Year 2022 Budget is scheduled for adoption on September 13 2022 and the corresponding Tax Year 2021 tax rate is scheduled for adoption on September 27 2021. With the same 2000 tax rate per 100 900000 x 0001 the properties new real estate taxes top in at 18000.

Compare Your Property Taxes Empire Center For Public Policy

Suffolk County Ny Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Nassau County 2018 Budget Would Raise Taxes 3 Fees News The Island Now

Nassau Daily Review Star Metropolitan Long Island Nassau County Freeport N Y 1937 1954 April 13 1942 Page 18 Image 18 Nys Historic Newspapers

Budget Plan Has Tax Rise For Nassau The New York Times

News Flash City Of Nassau Bay Civicengage

Pricing The Luxury Product New York City Taxes Under Mayor Bloomberg Empire Center For Public Policy

Dallek Taxpayers Rights Are Being Challenged By Nassau Assessments Long Island Business News

April 2021 Uf Ifas Nassau County Extension Service Report Uf Ifas Extension Nassau County

Nassau County Legislature Debates 105 Increase In Traffic Violation Fees The Osprey

Nassau County New York Property Tax Getjerry Com

1 Nassau County Department Of Assessment Unfair School Property Tax System Is It Time For An Income Tax Presented By Harvey B Levinson Chairman Board Ppt Download

County Data Nassau County Economic Development Board

Wichita Falls Isd Approves 2021 2022 Tax Rate

Make Sure That Nassau County S Data On Your Property Agrees With Reality

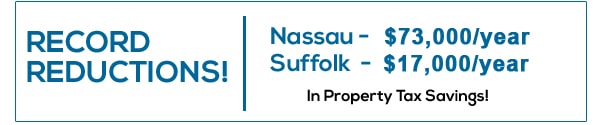

Nassau Suffolk Homeowners Will Be Hurt By Limiting Deductions Proposed By The Gop Tax Plan Property Tax Grievance Heller Consultants Tax Grievance

Nassau County S Property Tax Game The Winners And Losers

New Jersey Nj Tax Rate H R Block

1 Nassau County Department Of Assessment Unfair School Property Tax System Is It Time For An Income Tax Presented By Harvey B Levinson Chairman Board Ppt Download